写在前面的话

- 通过 米筐 网站提供的量化平台进行的测试。

- 做这个研究的初衷是笔者有一点意象投资股市,有几个不同的投资方案(策略),我想先拿 19 年的数据跑一跑我的方案(策略),如果亏钱了,就不玩股市,老老实实玩基金了。

关于如何读这个图

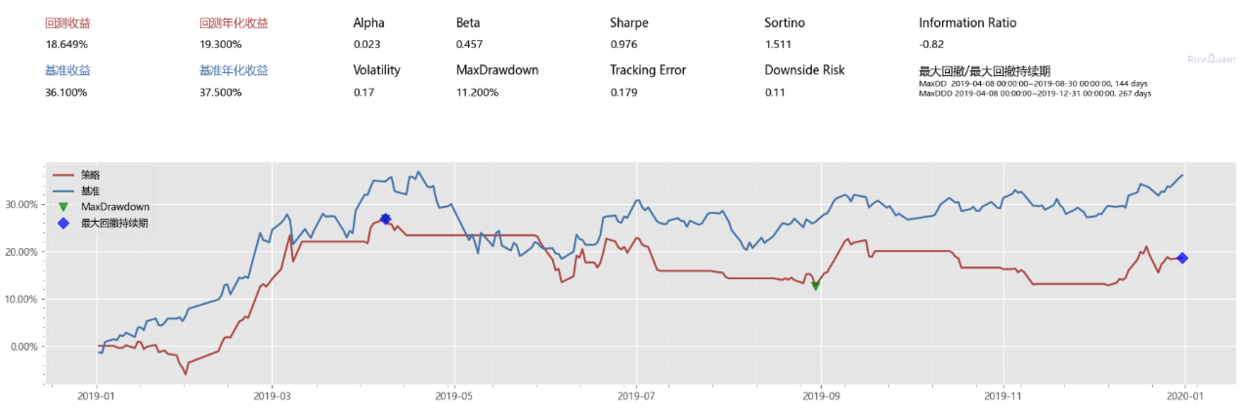

- 首先能看到时间,我的数据是从

2019 年 01 -- 2020 年 01, - 红色的线代表账户市值(把股票持仓也换算成钱)的变化。

- 蓝色的线代表基准(沪深三百)的市值变化。

- 其次最重要的指标,

回测收益,表示的是我本金到时间结束,涨了多少,比如我有 5w,那么这个图表示我年末结束涨到了5*(0.09+1) = 5.45(万元)。 - 然后平均一年能有 13.5%的收益。

- 然后看

基准收益, 这个我一般设置的是沪深三百,也就是大盘,这个图表示 19 年大盘涨了30+%,而我的策略只有9+%,其实是没有跑赢大盘的 (还不如买基金)。 - 然后需要注意下一个指标"MaxDrawdown(最大回测)": 最��大回撤是最常用的指标,描述了投资者可能面临的最大亏损。最大回撤的数值越小越好,越大说明风险越大。

- Sharpe(夏普率):夏普比率若为正值,代表基金报酬率大于风险;若为负值,代表基金风险大于报酬率。因此,夏普比率越高,投资组合越佳。

好了,下面开始正文。

检测低于 x 元的 股票 ,购买并持有 3 个礼拜后抛出

这个是一个普遍的购买思路,觉得底价股票一定会长,我短期持有然后等他高于某个价格就出售,我模拟一下这个情况,下面是代码:

#!/usr/bin/python3

# encoding: utf-8

# @Time : 2020/11/18 14:32

# @author : zza

# @Email : 740713651@qq.com

import warnings

import pandas

import rqdatac

__config__ = {

"base": {

"start_date": "20190101",

"end_date": "20191231",

'frequency': '1d',

"accounts": {

"stock": 5000,

}

},

"mod": {

"sys_progress": {

"enabled": True,

"show": True

}, "sys_accounts": {

"enabled": True,

"dividend_reinvestment": True,

},

"sys_analyser": {

"enabled": True,

"plot": True,

'benchmark': '000300.XSHG',

},

}

}

def init(context):

context.lowest = 5

context.highest = 5.9

context.day_count = 0

context.holding_days = 10

def get_ticker(context):

all_ins = rqdatac.all_instruments("Stock").order_book_id.to_list()

price_df = rqdatac.get_price(all_ins, context.now, context.now, expect_df=True, fields=['close'])

price_df = price_df.reset_index(drop=False)

price_df = price_df[(context.lowest <= price_df.close) & (price_df.close <= context.highest)]

start_date = rqdatac.get_previous_trading_date(context.now, 2)

price_df_2 = rqdatac.get_price(price_df.order_book_id.to_list(), start_date, context.now, expect_df=True,

fields=['close']).reset_index(drop=False)

order_ticker = []

for order_book_id, data_df in price_df_2.groupby(price_df_2.order_book_id):

if (data_df.close.shift(fill_value=0) < data_df.close).all():

order_ticker.append(order_book_id)

return order_ticker

def before_trading(context):

context.day_count += 1

if (context.day_count - 1) % context.holding_days == 0:

context.order_ticker = get_ticker(context)

def handle_bar(context, bar_dict):

if (context.day_count - 1) % context.holding_days == 0:

with warnings.catch_warnings():

for item in context.order_ticker:

o = order_target_value(item, 1000)

if o:

print(o)

if (context.day_count - 1) % context.holding_days == (context.holding_days-1):

for item in context.portfolio.positions.keys():

order_target_value(item, 0)

def after_trading(context):

print("total_value {}".format(context.portfolio.total_value))

if (context.day_count - 1) % 15 == 0:

items = []

for k, v in context.portfolio.positions.items():

items.append({"order_book_id": k, "quantity": v.quantity})

print(pandas.DataFrame(items))

if __name__ == '__main__':

import rqalpha

rqalpha.run_func(init=init,

before_trading=before_trading,

handle_bar=handle_bar,

after_trading=after_trading,

config=__config__)

-

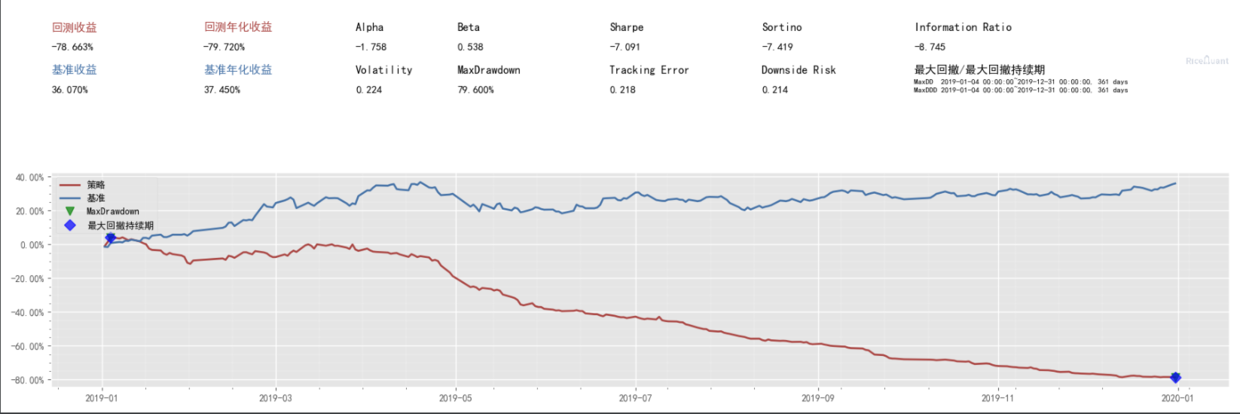

持有 3 个交易日

-

持有 10 个交易日

-

持有 15 个交易日

结论:底价股票确实会随着大盘的涨而有一定的波动,但最终都是会赔钱的,且三个交易的日的时候,直接赔钱了。这个图可以给广大读者的保佑侥幸心里的朋友看看,一年忙到头,不如买国运(沪深三百)。

根据公众号 闷声发小财

这个是根据我一个朋友跑的算法跑出来的可能会涨的概率。笔者拿到了他一年的数据(没用爬虫),然后试试能不能涨,这么跑的原因是,我当初确实想按着他的这个公众号来买,不过既然有回放数据测试,我当然先测试一下,本金本来就不多,挥霍不了,不敢随便教学费。

策略如下:

#!/usr/bin/python3

# encoding: utf-8

# @Time : 2020/11/22 16:33

# @author : zza

# @Email : 740713651@qq.com

# @File : 闷声发小财。py

import warnings

import numpy

import pandas

import rqdatac

from rqalpha.apis import *

__config__ = {

"base": {

"start_date": "20190101",

"end_date": "20191231",

'frequency': '1d',

"accounts": {

"stock": 5000,

},

"data_bundle_path": r"E:\data\bundle",

},

"extra": {

"log_level": "debug",

},

"mod": {

"sys_progress": {

"enabled": True,

"show": True

}, "sys_accounts": {

"enabled": True,

"dividend_reinvestment": True,

},

"sys_analyser": {

"enabled": True,

"plot": True,

'benchmark': '000300.XSHG',

},

},

}

def init(context):

context.df = pandas.read_csv("发小财。csv", dtype={"股票代码": numpy.str})

context.df['order_book_id'] = rqdatac.id_convert(context.df["股票代码"].to_list())

context.used_df = context.df[context.df["预测结果"] > 0.7]

context.sell_multiple = 1.08

context.holding_days = 1

context.buy_queen = []

context.sell_map = {}

def before_trading(context):

print("当日购买:{}".format(context.buy_queen))

print("当日持仓:{}".format(list(context.sell_map.keys())))

def handle_bar(context, bar_dict):

while context.buy_queen:

order_book_id = context.buy_queen.pop()

if context.stock_account.cash > 1000:

o = order_value(order_book_id, 1000)

if o:

trading_dt = get_next_trading_date(context.now, context.holding_days).to_pydatetime()

context.sell_map[order_book_id] = trading_dt

print("[{}] 购买成功".format(order_book_id))

else:

print("[{}] 资金不足,无法购买".format(order_book_id))

for order_id, dt in context.sell_map.copy().items():

a = dt.date() <= context.now.date()

b = bar_dict[order_id].close > get_position(order_id).avg_price # * context.sell_multiple

if a and b:

o = order_percent(order_id, -1)

if o:

del context.sell_map[order_id]

print("[{}] 卖出成功".format(order_id))

def dt_to_int(dt):

return dt.year * 10000 + dt.month * 100 + dt.day

def after_trading(context):

df = context.used_df[dt_to_int(context.now) == context.used_df.trading_dt]

if df.empty:

return

else:

for _, item in df.iterrows():

context.buy_queen.append(item["order_book_id"])

if __name__ == '__main__':

import rqalpha

rqalpha.run_func(init=init,

before_trading=before_trading,

handle_bar=handle_bar,

after_trading=after_trading,

config=__config__)

-

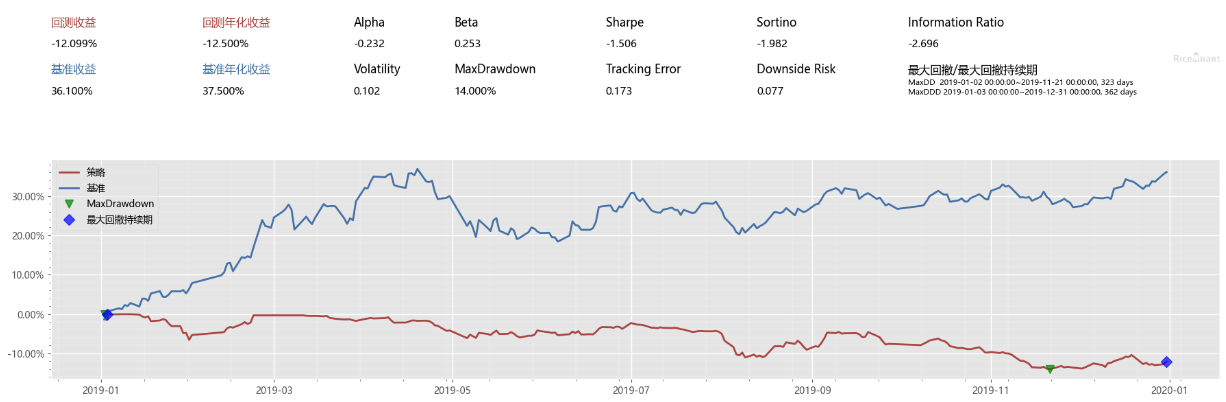

持有一天就卖出

-

持有 3 天并价格高于持仓价则卖出

结论:还好跑了回放测试,不然得教好多学费。

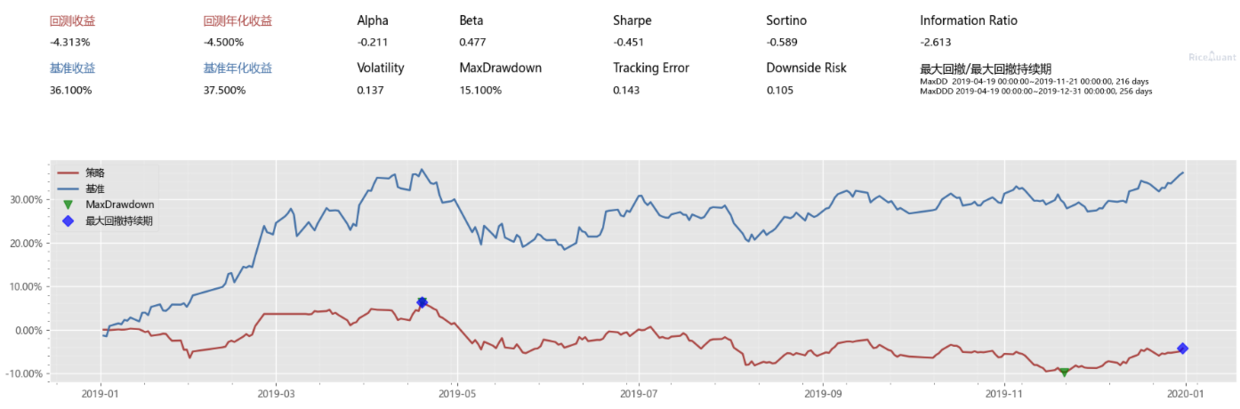

检测行业因子普遍 (90%) 一周内上涨的低价股票

这个也是我在上班的时候偶尔能想到的,我觉得可能也代表一分部分人的想法,**某个行业市场涨幅的时候,必定是全�行业性质的,且会持续一段时间。**于是我就写了这个,根据股票行业暴露度(属于哪个行业),分类行业,如果都涨了,就买进,如果都跌了,就卖出。

- 检测行业因子普遍 (90%) 一周内上涨的低价股票 购买并持有

- 在行业下跌在 30% 左右卖出

代码如下:

#!/usr/bin/python3

# encoding: utf-8

# @Time : 2020/11/22 16:33

# @author : zza

# @Email : 740713651@qq.com

# @File : 闷声发小财。py

from collections import defaultdict

from pprint import pprint

import numpy

import pandas

from rqalpha.apis import *

__config__ = {

"base": {

"start_date": "20190101",

"end_date": "20191231",

'frequency': '1d',

"accounts": {

"stock": 50000,

},

"data_bundle_path": r"E:\data\bundle",

},

"extra": {

"log_level": "debug",

},

"mod": {

"sys_progress": {

"enabled": True,

"show": True

}, "sys_accounts": {

"enabled": True,

"dividend_reinvestment": True,

},

"sys_analyser": {

"enabled": True,

"plot": True,

'benchmark': '000300.XSHG',

},

},

}

def get_holding_ticker():

# 请去米筐购买或申请试用 RQData : www.ricequant.com

rqdatac.init()

df = rqdatac.get_factor_exposure(rqdatac.all_instruments("Stock").order_book_id, "20190101", "20191231")

df.reset_index().sort_values("date").to_csv("factor_exposure.csv", index=False)

def init(context):

df = pandas.read_csv("factor_exposure.csv")

all_order_book_id = all_instruments().order_book_id.to_list()

context.df = df[df["order_book_id"].isin(all_order_book_id)]

context.buy_map = defaultdict(list)

context.holding_map = defaultdict(list)

context.sell_factors = []

context.day_count = 0

context.sell_multiple = 1.2

def before_trading(context):

pprint("当日购买行业:{}".format(context.buy_map))

print("当日持仓:{}".format([i.order_book_id for i in get_positions()]))

print("年化:{}".format(context.portfolio.total_returns))

def handle_bar(context, bar_dict):

# buy

for factors, order_book_ids in context.buy_map.items():

if context.stock_account.cash < 2000:

break

for order_book_id in order_book_ids.copy():

o = order_value(order_book_id, 2000)

if o:

context.holding_map[factors].append(order_book_id)

order_book_ids.remove(order_book_id)

# sell

for factors in context.sell_factors:

for order_book_id in context.holding_map[factors].copy():

# a = bar_dict[order_book_id].close > get_position(order_book_id).avg_price * context.sell_multiple

a = True

if a:

o = order_percent(order_book_id, -1)

if o:

context.holding_map[factors].remove(order_book_id)

def dt_to_str(dt):

return "{}-{}-{}".format(dt.year, dt.month, dt.day)

def is_rise(order_book_id):

a, b = history_bars(order_book_id, 2, frequency="1d", fields='close')

return b > a

def after_trading(context):

context.day_count += 1

if context.day_count % 5 != 1:

return

df = context.df[context.now.date().isoformat() == context.df.date].copy()

df.loc[:, 'rose'] = df["order_book_id"].apply(is_rise)

df.loc[:, 'close'] = df["order_book_id"].apply(lambda x: history_bars(x, 1, frequency="1d", fields='close'))

context.sell_factors = []

context.buy_map = defaultdict(list)

for factors in df.columns[13:-2]:

_df = df[df[factors] == 1]

if _df['rose'].sum() / _df['order_book_id'].size > 0.9:

context.buy_map[factors] = _df[(_df["close"] > 5) & (_df["close"] < 6)].sort_values('close')[

'order_book_id'].to_list()[:2]

elif _df['rose'].sum() / _df['order_book_id'].size < 0.3:

context.sell_factors.append(factors)

del df

if __name__ == '__main__':

import rqalpha

rqalpha.run_func(init=init,

before_trading=before_trading,

handle_bar=handle_bar,

after_trading=after_trading,

config=__config__)

- 各行业两只股票

emmm,不说了,都是磊。

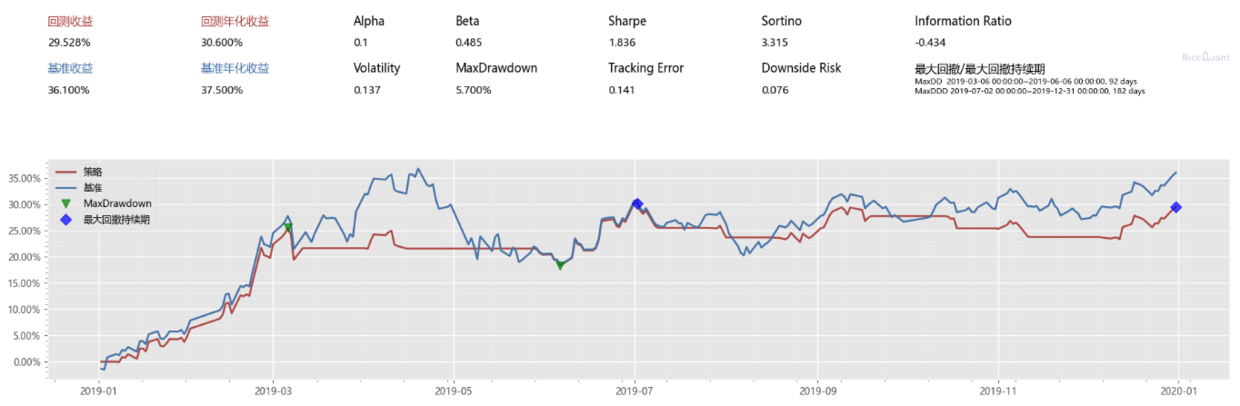

普通 macd 均线策略

- 这个是米筐官网的默认策略

from collections import defaultdict

from pprint import pprint

import numpy

import pandas

from rqalpha.apis import *

__config__ = {

"base": {

"start_date": "20190101",

"end_date": "20191231",

'frequency': '1d',

"accounts": {

"stock": 50000,

},

"data_bundle_path": r"E:\data\bundle",

},

"extra": {

"log_level": "debug",

},

"mod": {

"sys_progress": {

"enabled": True,

"show": True

}, "sys_accounts": {

"enabled": True,

"dividend_reinvestment": True,

},

"sys_analyser": {

"enabled": True,

"plot": True,

'benchmark': '000300.XSHG',

},

},

}

import talib

def init(context):

context.s1 = '000300.XSHG'

context.SHORTPERIOD = 12

context.LONGPERIOD = 26

context.SMOOTHPERIOD = 9

context.OBSERVATION = 100

subscribe(context.s1)

def before_trading(context):

pass

def handle_bar(context, bar_dict):

closes = history_bars(context.s1, context.OBSERVATION, '1d', 'close')

diff, signal, _ = talib.MACD(closes)

if diff[-1] > signal[-1] and diff[-2] < signal[-2]:

order_target_percent(context.s1, 1)

if diff[-1] < signal[-1] and diff[-2] > signal[-2]:

order_target_percent(context.s1, 0)

def after_trading(context):

pass

if __name__ == '__main__':

import rqalpha

rqalpha.run_func(init=init,

before_trading=before_trading,

handle_bar=handle_bar,

after_trading=after_trading,

config=__config__)

这个是根据大佬的代码抄的。其实数据还行,虽然没跑赢沪深三百,但是确实赚钱了,贴一下 源地址, 大佬说有一部分巧合在里面。不多说了。

我结合下只买五块钱的情况

#!/usr/bin/python3

# encoding: utf-8

# @Time : 2020/11/22 16:33

# @author : zza

# @Email : 740713651@qq.com

# @File : 闷声发小财。py

import numpy

import pandas

from rqalpha.apis import *

__config__ = {

"base": {

"start_date": "20190101",

"end_date": "20191231",

'frequency': '1d',

"accounts": {

"stock": 50000,

},

"data_bundle_path": r"E:\data\bundle",

},

"extra": {

"log_level": "debug",

},

"mod": {

"sys_progress": {

"enabled": True,

"show": True

}, "sys_accounts": {

"enabled": True,

"dividend_reinvestment": True,

},

"sys_analyser": {

"enabled": True,

"plot": True,

'benchmark': '000300.XSHG',

},

},

}

import talib

def init(context):

context.s1 = '000300.XSHG'

context.SHORTPERIOD = 12

context.LONGPERIOD = 26

context.SMOOTHPERIOD = 9

context.OBSERVATION = 100

subscribe(context.s1)

context.lowest = 5

context.highest = 6

context.order_ticker = []

def _history_bar_for_all_ins(x):

bar = history_bars(x, 1, "1d", fields=['close'])

if not bar:

return numpy.nan

if bar[0]:

return bar[0][0]

return numpy.nan

def get_ticker(context):

all_ins = all_instruments("Stock").order_book_id.to_list()

df = pandas.DataFrame(all_ins, columns=['order_book_id'])

df['close'] = df.order_book_id.apply(_history_bar_for_all_ins)

price_df = df[(context.lowest <= df.close) & (df.close <= context.highest)]

order_ticker = []

for order_book_id in price_df.order_book_id.to_list():

c = pandas.Series(i[0] for i in history_bars(order_book_id, 3, "1d", fields=['close']))

if (c.shift(fill_value=0) < c).all():

order_ticker.append(order_book_id)

return order_ticker

def before_trading(context):

print("年化:{}".format(context.portfolio.total_returns))

def handle_bar(context, bar_dict):

closes = history_bars(context.s1, context.OBSERVATION, '1d', 'close')

diff, signal, _ = talib.MACD(closes)

if diff[-1] > signal[-1] and diff[-2] < signal[-2] :

if context.stock_account.cash > 1000:

context.order_ticker = get_ticker(context)

for item in context.order_ticker:

o = order_target_value(item, 2000)

if o:

print(o)

print("context.order_ticker", context.order_ticker)

if diff[-1] < signal[-1] and diff[-2] > signal[-2]:

for item in context.portfolio.positions.keys():

order_target_percent(item, 0)

def after_trading(context):

context.order_ticker = []

if __name__ == '__main__':

import rqalpha

rqalpha.run_func(init=init,

before_trading=before_trading,

handle_bar=handle_bar,

after_trading=after_trading,

config=__config__)

还不如直接买华夏国运沪深三百。

朋友想法 A

试试朋友的想法

假如设置一个均值(一直在变),低于 0.8 倍均值(mean_coe),并且连续 fall_days 天,跌幅加起来达到 fall_x%,买入 高于买入价格,并且连续 rise_days 天,涨幅加起来达到 rise_x%,卖出

我开始简单的设置了几个参数,发现结果不是很理想,但是没亏,我就想可能是参数的问题,然后列出了个集合,想着再跑跑,代码如下:

#!/usr/bin/python3

# encoding: utf-8

# @Time : 2020/11/22 16:33

# @author : zza

# @Email : 740713651@qq.com

import itertools

import numpy

import pandas

from rqalpha.apis import *

__config__ = {

"base": {

"start_date": "20190101",

"end_date": "20191231",

'frequency': '1d',

"accounts": {

"stock": 50000,

},

"data_bundle_path": r"E:\data\bundle",

},

"extra": {

"log_level": "debug",

},

"mod": {

"sys_progress": {

"enabled": True,

"show": True

}, "sys_accounts": {

"enabled": True,

"dividend_reinvestment": True,

},

"sys_analyser": {

"enabled": True,

"plot": True,

'benchmark': '000300.XSHG',

},

},

}

def init(context):

context.mean_coe = 0.8

context.mean_days = 244

context.rise_days = context.config.extra.rise_days

context.fall_days = context.config.extra.fall_days

context.rise_x = context.config.extra.rise_x

context.fall_x = context.config.extra.fall_x

context.order_ticker = [

"002111.XSHE", # 威海广泰

"002673.XSHE", # 西部证券

"601375.XSHG", # 中原证券

]

df = all_instruments('CS')

df = df[df.listed_date.apply(lambda x: x.year in [2015, 2016, 2017])]

context.order_ticker = context.order_ticker + df.order_book_id.to_list()

def before_trading(context):

print("年化:{}".format(context.portfolio.total_returns))

# 价格均值

context.mean_close = {}

for order_book_id in context.order_ticker:

bars = pandas.Series([i[0] for i in history_bars(order_book_id, context.mean_days, "1d", fields=['close'])])

context.mean_close[order_book_id] = bars.mean()

def handle_bar(context, bar_dict):

# for buy

if context.stock_account.cash >= 5000:

for order_book_id in context.order_ticker:

bar_close = bar_dict[order_book_id].close

if bar_close < (context.mean_close[order_book_id] * context.mean_coe):

_str = ""

bars = pandas.Series(

[i[0] for i in history_bars(order_book_id, context.fall_days, "1d", fields=['close'])])

_str += "\n" + f"[{order_book_id}] 价格 ({bar_close}) 低于一年平均价{context.mean_close[order_book_id]}"

if not (bars.shift(-1, fill_value=0) < bars).all():

# 判断连跌

continue

_str += "\n" + f"[{order_book_id}] 连跌 价格表现为{list(bars)}"

if not (bars[0] * context.fall_x > bar_close):

# 判断跌幅

# 非低于 0.8 倍均值(mean_coe)

continue

_str += "\n" + f"[{order_book_id}] 跌幅超过{context.fall_x}, {bars[0]} - {bar_close}"

o = order_value(order_book_id, 5000)

if o:

_str += "\n" + f"[{order_book_id}] 买入".format(order_book_id)

print(_str)

# for sell

for order_book_id in context.order_ticker:

position = context.portfolio.positions[order_book_id]

bar_close = bar_dict[order_book_id].close

if position is None or position.quantity <= 0:

continue

if position.avg_price < bar_close:

# 低于买入价格 不做操作

continue

_str = ""

bars = pandas.Series([i[0] for i in history_bars(order_book_id, context.fall_days, "1d", fields=['close'])])

if not (bars.shift(1, fill_value=0) < bars).all():

# 并且连续 rise_days 天

continue

_str += "\n" + f"[{order_book_id}] 连涨 价格表现为{list(bars)}"

if not (bars[0] * context.rise_x < bar_close):

# 涨幅加起来达到 rise_x%

continue

_str += "\n" + f"[{order_book_id}] 涨幅超过{context.rise_x}, {bars[0]} - {bar_close}"

o = order_target_percent(order_book_id, 0)

if o:

_str += "\n" + f"[{order_book_id}] 出售".format(order_book_id)

print(_str)

def after_trading(context):

pass

import rqalpha

rise_days = range(3, 10)

fall_days = range(3, 10)

rise_x = numpy.arange(1.06, 1.12, 0.01)

fall_x = numpy.arange(0.9, 0.94, 0.01)

config_map = itertools.product(rise_days, fall_days, rise_x, fall_x)

df = pandas.DataFrame(config_map, columns=["rise_days", "fall_days", "rise_x", "fall_x", ])

result_list = []

for _, item in df.iterrows():

__config__['extra']['rise_days'] = int(item.rise_days)

__config__['extra']['fall_days'] = int(item.fall_days)

__config__['extra']['rise_x'] = item.rise_x

__config__['extra']['fall_x'] = item.fall_x

result = rqalpha.run_func(init=init,

before_trading=before_trading,

handle_bar=handle_bar,

after_trading=after_trading,

config=__config__)

total_returns = result['sys_analyser']['summary']['total_value']

result_list.append(result)

其实跑出了几个超过大盘收益的结果。但是因为我的代码水平问题,报错了,结果也没保存,近期我会去吧这个跑完(1300 多的组合方式),有结果了我会贴上最优解的。

总结

我还是不在股票市场里当韭菜了 溜了溜了